y-n.site Learn

Learn

How Can You Use Google Pay

Select Google Pay at checkout. Choose your Chase card when you tap on the Buy with Google Pay button or use Chrome Autofill and check out without having to. Google Pay is a digital wallet that allows customers to make contactless payments using their smartphones and tablets. Pay in a store · Step 1: Wake up & unlock your phone · Step 2: Hold the back of your phone to the payment reader · Step 3: If prompted, follow the on-screen. Google Pay is a mobile payment technology that allows you to use your Android ® device to make convenient, secure purchases with your U.S. Bank commercial card. Use your Citizens Visa debit card with Google Pay for a fast and secure checkout experience. Learn more and get started today. Google Pay allows you to pay for your purchases with your Android™ phone by holding your phone near a contactless reader at participating merchants. How will I. Open the Google Wallet app or download it on Google Play. Tap 'Add to Wallet', follow the instructions, and verify your card if needed. You're all set! How to add your card to Google Pay · Open your Google Wallet · Select Add to Wallet · Select Payment card and then New credit or debit card · Scan your card or. Google Wallet gives you fast, secure access to your everyday essentials. Tap to pay everywhere Google Pay is accepted, board a flight, go to a movie. Select Google Pay at checkout. Choose your Chase card when you tap on the Buy with Google Pay button or use Chrome Autofill and check out without having to. Google Pay is a digital wallet that allows customers to make contactless payments using their smartphones and tablets. Pay in a store · Step 1: Wake up & unlock your phone · Step 2: Hold the back of your phone to the payment reader · Step 3: If prompted, follow the on-screen. Google Pay is a mobile payment technology that allows you to use your Android ® device to make convenient, secure purchases with your U.S. Bank commercial card. Use your Citizens Visa debit card with Google Pay for a fast and secure checkout experience. Learn more and get started today. Google Pay allows you to pay for your purchases with your Android™ phone by holding your phone near a contactless reader at participating merchants. How will I. Open the Google Wallet app or download it on Google Play. Tap 'Add to Wallet', follow the instructions, and verify your card if needed. You're all set! How to add your card to Google Pay · Open your Google Wallet · Select Add to Wallet · Select Payment card and then New credit or debit card · Scan your card or. Google Wallet gives you fast, secure access to your everyday essentials. Tap to pay everywhere Google Pay is accepted, board a flight, go to a movie.

Open the Google Pay app and Tap New payment. Step 2 of 9 Tap Bill payment. Step 3 of 9 Tap Add a payment. Step 4 of 9 Tap a payment category type. Simply unlock your phone, no need to open the Google Pay app. Hold your phone close to the payment terminal and await confirmation. If prompted, follow the. How do I make a payment with my Google Pay Digital Wallet in a store? Unlock your phone and hold the device close to terminal. There is no requirement to open. As a Huntington customer, you can connect your Huntington credit card or Huntington debit card with the Google Pay app. Once you've downloaded the app, you can. You can use Google Pay to send or request money from family and friends using a mobile phone. You can also pay your utility bills and recharge your prepaid. Login to your N26 mobile app and go to the Cards tab in the bottom right corner. Right below the card of your choice, you will be able to add it to Google Pay. Most major retailers are accepting both Android and Apple Pay. But now any business of any size can accept Google Pay with Square's new contactless and chip. Confirm your identity (with a PIN, pattern lock, fingerprintFootnote 1 or iris scan) on your device, and tap to pay at any business that displays the. Step 1: Define your Google Pay API version. · Step 2: Choose a payment tokenization method. · Step 3: Define supported payment card networks. · Step 4: Describe. Google Pay (formerly Android Pay) is a mobile payment service developed by Google to power in-app, online, and in-person contactless purchases on mobile. A faster, safer, easier way to pay. When you add your payment cards to Google Wallet, you can tap to pay anywhere Google Pay is accepted. And know your. Important update: The U.S. version of the standalone Google Pay app is no longer available for use. Please download the Google Wallet app to tap and pay. Google Pay Guide · You do not need to open the Google Pay® application · If you have multiple cards and wish to make another your default card, tap and hold the. Google Pay lets you use your phone to pay in stores with most credit or debit cards across eligible Android devices. It also lets you send and request money. How does Google Wallet work in apps? · Open a supported app, like Uber or Airbnb. · At checkout or time of purchase, look for the Buy with Google Pay button. Google Pay lets you use your phone to pay in stores with most credit or debit cards across eligible Android devices. It also lets you send and request money. Google Pay provides owners of Android devices the ability to use their Android phone to make in store, in-app and online payments using an eligible Chase. Add your Capital One card to Google Pay for a safer, simpler way to pay online, in stores and in apps. Most major retailers are accepting both Android and Apple Pay. But now any business of any size can accept Google Pay with Square's new contactless and chip. Confirm your identity (with a PIN, pattern lock, fingerprintFootnote 1 or iris scan) on your device, and tap to pay at any business that displays the.

Sdc Smile Direct Club

SmileDirectClub, Inc.'s stock symbol is SDCCQ and currently trades under OTCMKTS. It's current price per share is approximately $ In this video, we're going to explain how smiledirectclub, a 9 billion dollar company, went bankrupt. Smiledirectclub was a popular direct. SmileDirectClub Announces U.S. Launch of Patented SmileMaker Platform · SmileDirectClub Adds Innovative Sensitivity-Free Whitening Kit to Its Oral Care. On September 29, , SmileDirectClub, Inc. and eight (8) affiliated debtors (collectively, the "Debtors") each filed a voluntary petition for relief under. r/smiledirectclub: This community provides unofficial support for those using SmileDirectClub (as well as all of the other aligner companies!) Check. SMILE STRETCHER. SMILE DIRECT CLUB. NEW IN BOX NIB. Help with oral care and access to your teeth! I DO NOT DO TRADES. SmileDirectClub, Inc., an oral care company, offers clear aligner therapy treatment. The company manages the end-to-end process, which include marketing. Why SmileDirectClub Stock Was Plummeting Today. Despite new product innovations, the company is dangerously close to running out of money. Billy Duberstein |. r/smiledirectclub: This community provides unofficial support for those using SmileDirectClub (as well as all of the other aligner companies!) Check. SmileDirectClub, Inc.'s stock symbol is SDCCQ and currently trades under OTCMKTS. It's current price per share is approximately $ In this video, we're going to explain how smiledirectclub, a 9 billion dollar company, went bankrupt. Smiledirectclub was a popular direct. SmileDirectClub Announces U.S. Launch of Patented SmileMaker Platform · SmileDirectClub Adds Innovative Sensitivity-Free Whitening Kit to Its Oral Care. On September 29, , SmileDirectClub, Inc. and eight (8) affiliated debtors (collectively, the "Debtors") each filed a voluntary petition for relief under. r/smiledirectclub: This community provides unofficial support for those using SmileDirectClub (as well as all of the other aligner companies!) Check. SMILE STRETCHER. SMILE DIRECT CLUB. NEW IN BOX NIB. Help with oral care and access to your teeth! I DO NOT DO TRADES. SmileDirectClub, Inc., an oral care company, offers clear aligner therapy treatment. The company manages the end-to-end process, which include marketing. Why SmileDirectClub Stock Was Plummeting Today. Despite new product innovations, the company is dangerously close to running out of money. Billy Duberstein |. r/smiledirectclub: This community provides unofficial support for those using SmileDirectClub (as well as all of the other aligner companies!) Check.

SmileDirectClub is an oral care company and creator of the first medtech platform for teeth straightening, now also offered directly via dentist and. SmileDirectClub facing liquidation SmileDirectClub filed for Chapter 11 bankruptcy protection and is looking for a buyer for its direct-to-consumer. Smile Direct Club (SDC) is a healthcare business using a solutions business model to provide fully customized, 3D printed, plastic orthodontic aligners to. The Investor Relations website contains information about SmileDirectClub's business for stockholders, potential investors, and financial analysts. SmileDirectClub partners with leading medical aesthetic provider Thérapie Clinic to expand SmileShop reach in UK and Ireland. SmileDirectClub was shut down in December , less than three months after filing for Chapter 11 bankruptcy. SmileDirectClub, LLC. Assuming SDC uses $80m of its DIP, in liquidation, DIP will receive a recovery of (total payback ~$90m including interest & fees). Next in. SmileDirectClub – Fourth Quarter and Year End Earnings Call. Mar 1, at AM EST. Listen to Webcast. Supporting Materials. Both Invisalign and Smile Direct Club (SDC) rely on using clear trays to straighten teeth, but how the treatment plan is created and delivered is different. SDC - Smiledirectclub Inc - Class A Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (NASDAQ). SmileDirectClub, Inc. Union Street Nashville, Tennessee () (Address, Including Zip Code, and Telephone Number, Including Area Code. SmileDirectClub Inc stock price live, this page displays OTC SDCCQ stock exchange data. View the SDCCQ premarket stock price ahead of the market session. SDC - Smiledirectclub Inc - Class A Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (NASDAQ). Easily switch to Dr. Direct Retainers from SmileDirectClub without the need for a new dental impression kit. Enjoy the best prices on top-quality. SmileDirectClub has reached an agreement with the Office of District of Columbia Attorney General to resolve the litigation brought against the company. The. Stock analysis for SmileDirectClub Inc (SDC:US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. y-n.site · Nashville, TN · to Employees · 16 Locations · Type: Company - Public (SDC) · Founded in · Revenue: Unknown / Non-Applicable. Our proprietary treatment planning software, SmileOS, is the foundation for clear aligner therapy with SmileDirectClub. We are committed to enhancing its. On September 29, , SmileDirectClub, Inc. and eight (8) affiliated debtors (collectively, the "Debtors") each filed a voluntary petition for relief under. Stock analysis for SmileDirectClub Inc (SDC:US) including stock price, stock chart, company news, key statistics, fundamentals and company profile.

How Can I Buy Home Depot Stock

HD | Complete Home Depot Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Home Depot is a US-based multinational big-box retailer focusing on the home improvement market. It is the largest home improvement retailer in the US. For general employee stock plan inquiries, please contact: Home Depot Stock Administration [email protected] View Home Depot, Inc. HD stock quote prices, financial information, real Buy from Wells Fargo by TipRanks Aug 18 pm ET Analysts Offer Insights. You can invest in the common stock of The Home Depot, Inc. through many financial institutions such as full-service brokers, discount brokers and online brokers. In the last year, 19 stock analysts published opinions about HD-N. 16 analysts recommended to BUY the stock. 2 analysts recommended to SELL the stock. The. Log onto y-n.site and go to Finances > Investment & Retirement > Employee Stock Purchase Program. The program starts twice a year. Macroaxis provides Home Depot buy-hold-or-sell recommendation only in the context of selected investment horizon and investor attitude towards risk assumed by. You may make optional cash investments by sending to Computershare, the program administrator, a check for the purchase of additional shares of our common stock. HD | Complete Home Depot Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Home Depot is a US-based multinational big-box retailer focusing on the home improvement market. It is the largest home improvement retailer in the US. For general employee stock plan inquiries, please contact: Home Depot Stock Administration [email protected] View Home Depot, Inc. HD stock quote prices, financial information, real Buy from Wells Fargo by TipRanks Aug 18 pm ET Analysts Offer Insights. You can invest in the common stock of The Home Depot, Inc. through many financial institutions such as full-service brokers, discount brokers and online brokers. In the last year, 19 stock analysts published opinions about HD-N. 16 analysts recommended to BUY the stock. 2 analysts recommended to SELL the stock. The. Log onto y-n.site and go to Finances > Investment & Retirement > Employee Stock Purchase Program. The program starts twice a year. Macroaxis provides Home Depot buy-hold-or-sell recommendation only in the context of selected investment horizon and investor attitude towards risk assumed by. You may make optional cash investments by sending to Computershare, the program administrator, a check for the purchase of additional shares of our common stock.

The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is currently willing to pay. Real-time Price Updates for Home Depot (HD-N), along with buy or sell indicators, analysis, charts, historical performance, news and more. Date, Action, Analyst, Rating Change, Price Target Change. Jul, Resumed, Jefferies, Buy, $ Jun, Upgrade, DA Davidson, Neutral → Buy. The Home Depot Direct Stock Purchase Plan (DSPP) enables you to invest a minimum amount in Home Depot stock and build your stock ownership over time. You can invest in the common stock of The Home Depot, Inc. through many financial institutions such as full-service brokers, discount brokers and online. For general employee stock plan inquiries, please contact: Home Depot Stock Administration [email protected] The The Home Depot stock price is USD today. How to buy The Home Depot stock online? You can buy The Home Depot shares by opening an account at a top. Own a part of the apron by joining the Employee Stock Purchase Plan (ESPP). Building ownership in The Home Depot means you can further share in the success of. Langone's Home Depot shares are currently valued at $B. If you're new to stock investing, here's how to buy Home Depot stock. © WallStreetZen. Based on 23 Wall Street analysts offering 12 month price targets for Home Depot in the last 3 months. The average price target is $ with a high forecast. The latest Home Depot stock prices, stock quotes, news, and HD history to help you invest and trade smarter. View the real-time HD price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Get Home Depot Inc (HD:NYSE) real-time stock quotes, news, price and financial information from CNBC. Home Depot Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Get the latest Home Depot Inc. (The) (HD) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. View today's Home Depot Inc stock price and latest HD news and analysis. Create real-time notifications to follow any changes in the live stock price. You get 15% off. They are purchasing stocks for you in January and July. Unfortunately, that's where the stock price is fairly high. The Fund Sentiment Score (fka Ownership Accumulation Score) finds the stocks that are being most bought by funds. It is the result of a sophisticated, multi-. The current price of HD is USD — it has decreased by −% in the past 24 hours. Watch Home Depot, Inc. (The) stock price performance more closely on. Buy Stock Direct · Investor Documents · SEC Filings · About Us · Investor Relations · THD Canada · THD Mexico · Careers · Suppliers · Privacy & Security.

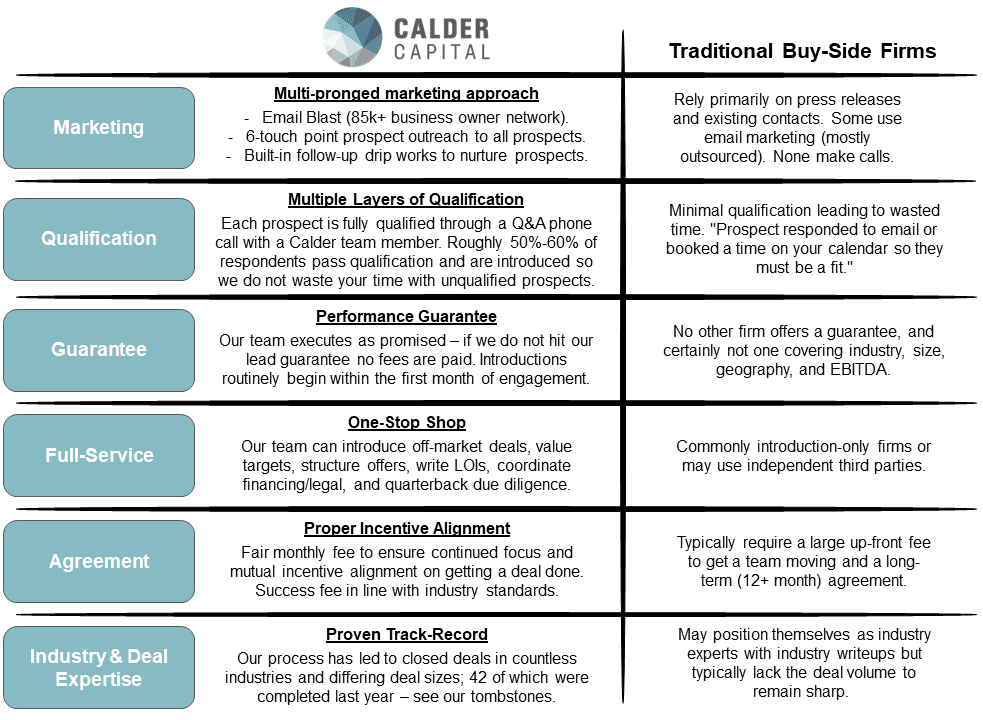

Buy Side Firms

depends on the PM and the firm · HF pays better than sell side and by sell side I was referring to investment banks like Goldman or JP. Prop shop. Many firms are evaluating NDF streaming and algo solutions available in the market due to the potential efficiency gains and the survey results confirmed this. The untold truth is that actually the work itself in buy side is not that much more complicated than in sell side. But it is just so competitive. Our dedicated buy-side advisory practice augments Private Equity firms and their portfoli to provide a proactive strategy to source, engage, and execute on. Pension funds; Hedge funds; Mutual funds; Insurance firms. Related: 10 Jobs in Financial Securities (With. You'll learn directly from Wharton School faculty, experienced investors and leaders from some of the top buy-side investment firms in the world. buy-side and. Buy-side firms consist of asset managers, hedge funds, and other firms that buy or sell securities on behalf of their clients. Buy-side analysts will determine. Buy-side is a term used in investment firms to refer to advising institutions concerned with buying investment services. Private equity funds, mutual funds. The buy side broadly refers to money managers, or “institutional investors”. Examples of institutional investors include private equity firms (PE) and hedge. depends on the PM and the firm · HF pays better than sell side and by sell side I was referring to investment banks like Goldman or JP. Prop shop. Many firms are evaluating NDF streaming and algo solutions available in the market due to the potential efficiency gains and the survey results confirmed this. The untold truth is that actually the work itself in buy side is not that much more complicated than in sell side. But it is just so competitive. Our dedicated buy-side advisory practice augments Private Equity firms and their portfoli to provide a proactive strategy to source, engage, and execute on. Pension funds; Hedge funds; Mutual funds; Insurance firms. Related: 10 Jobs in Financial Securities (With. You'll learn directly from Wharton School faculty, experienced investors and leaders from some of the top buy-side investment firms in the world. buy-side and. Buy-side firms consist of asset managers, hedge funds, and other firms that buy or sell securities on behalf of their clients. Buy-side analysts will determine. Buy-side is a term used in investment firms to refer to advising institutions concerned with buying investment services. Private equity funds, mutual funds. The buy side broadly refers to money managers, or “institutional investors”. Examples of institutional investors include private equity firms (PE) and hedge.

Institutional investors represent a part of the financial markets known as the buy side, for which we've compiled a list of largest investors. G2's Buy-Side Advisory brings invaluable industry expertise and seeks to become trusted advisors and strategic partners in growing our clients' businesses. buy-side firms. Best IBOR (investment book of record) platform/service The winning entry in this category must support buy-side firms' transparency. Expand distribution of your deals confidentially to targeted private equity firms and keep % of your deal fee. “Buy-side firms” raise money from institutions and wealthy individuals and invest on their behalf, profiting from management fees, performance fees, or both. Once considered simply a conduit between the front and back office, the middle office is playing a more active part in the investment process for buy-side firms. The Most Comprehensive List of Sell-side Equity Research Firms · Richard Toad · Large Investment Banks · US Boutique Research (industry specialty. Generally speaking, buy-side analysts will conduct research into different stocks and make recommendations for investments. Managers will typically conduct the. Currently, buy-side firms deliver trade data to executing brokers and prime brokers separately. The trade and allocations details are sent to the prime broker. Buy-side analysts ("buy-siders") work for buy side money management firms such as mutual funds, pension funds, trusts, family offices, and hedge funds. The “buy-side” refers to the firms that invest in securities (eg stocks, bonds, etc.), like private equity funds, pension funds, and investment managers. Buy-side is a term used in investment firms to refer to advising institutions concerned with buying investment services. Private equity funds, mutual funds. Institutional investors represent a part of the financial markets known as the buy side, for which we've compiled a list of largest investors. Increasingly, we are seeing larger and more sophisticated buy-side firms considering how they can: Optimize trading; Gain efficiencies and cost savings; Scale. The Dinan & Company name is practically synonymous with success in buy side M&A. We have developed a particular expertise in generating proprietary deal. I'm wondering how buy side traders actually work and though I'm finding one here. Most prop firms are only algorithms I read, so it's just putting maths into a. Buyside Hustle is a top finance blog dedicated to Investment Banking, Private Equity and Hedge Fund careers, with tens of thousands of monthly visitors. Tradeweb Direct provides buy-side firms access to one of the largest fixed-income marketplaces in the U.S., ensuring unprecedented transparency and. Private Market Investors typically consist of Venture Capital, Growth Equity and LBO firms. The Sellside consists of Investment Banks (IB) that 'sell' advisory. Look no further than Selby Jennings, a leading buy side recruitment firm specializing in connecting top-tier buy-side professionals with prestigious financial.

Spy 500 List

The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80%. The S&P is a market index that represents the performance of about companies in the United States. · Only large-cap companies who fit pre-specified. Get a complete List of all S&P stocks. The values of #name# companies consists live prices and previous close price, as well as daily, 3-, 6- and 1-year. S&P companies are often considered most representative of the key industries in the economy, and they tend to be large-cap stocks with relatively higher. S&P Index ; Open. 5, Previous Close5, ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range4, - 5, Find the latest S&P (^GSPC) stock quote, history, news and other vital information to help you with your stock trading and investing. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. Top 10 S&P companies · 1. Microsoft (MSFT) · 2. Nvidia Corp. (NVDA) · 3. Apple (AAPL) · 4. y-n.site Inc. (AMZN) · 5. Meta Platforms Class A (META) · 6. Bloomberg Ticker: SP5T5. The S&P Top 50 consists of 50 of the largest companies from the S&P , reflecting U.S. mega-cap performance. Index constituents. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80%. The S&P is a market index that represents the performance of about companies in the United States. · Only large-cap companies who fit pre-specified. Get a complete List of all S&P stocks. The values of #name# companies consists live prices and previous close price, as well as daily, 3-, 6- and 1-year. S&P companies are often considered most representative of the key industries in the economy, and they tend to be large-cap stocks with relatively higher. S&P Index ; Open. 5, Previous Close5, ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range4, - 5, Find the latest S&P (^GSPC) stock quote, history, news and other vital information to help you with your stock trading and investing. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. Top 10 S&P companies · 1. Microsoft (MSFT) · 2. Nvidia Corp. (NVDA) · 3. Apple (AAPL) · 4. y-n.site Inc. (AMZN) · 5. Meta Platforms Class A (META) · 6. Bloomberg Ticker: SP5T5. The S&P Top 50 consists of 50 of the largest companies from the S&P , reflecting U.S. mega-cap performance. Index constituents.

S&P Stocks ; ▽ %, APTV, Aptiv PLC ; △ %, ACGL, Arch Capital Group Ltd ; △ %, ADM, Archer-Daniels-Midland Company ; ▽ %, ANET, Arista. The S&P is regarded as a gauge of the large cap U.S. equities market. The index includes leading companies in leading industries of the U.S. economy. About S&P Index. . Standard and Poor's Index is a capitalization-weighted stock market index measuring the performance of large publicly traded. The index includes leading companies and captures approximately 80% coverage of available market capitalization. Popular Securities. Dow Jones Industrial. Top 25 Companies by Index Weight ; 1, MICROSOFT (MSFT): % ; 2, APPLE (APPL): % ; 3, NVIDIA (NVDA): % ; 4, y-n.site, INC (AMZN): %. The Fund will invest at least 90% of its total assets in securities that comprise the Index. The Index is composed of 50 of the largest companies in the S&P. S&P - ETF components iShares Core S&P ETF - USD ; APPLE INC. Stock Apple Inc. ; MICROSOFT CORPORATION · Stock Microsoft Corporation. ; AMAZON. sp_y-n.site( kB) ; AAPL. Apple Inc. Apple Inc. ; NVDA. NVIDIA Corporation. NVIDIA Corporation ; MSFT. Microsoft Corporation. Microsoft Corporation. The S&P (SPX) tracks the stock performance of of the largest publicly-traded companies in the U.S. See the S&P chart, Overview, news, ETFs. S&P ETFs in comparison ; iShares Core S&P UCITS ETF USD (Dist)IE, 16, ; Vanguard S&P UCITS ETF (USD) AccumulatingIE00BFMXXD54, 12, This page lists the component companies of the S&P , sorted by market capitalization. S&P Index · S&P Index ($SPX) · Percentage of S&P Stocks Above Moving Average · Summary of S&P Stocks With New Highs and Lows · S&P ETF. List of companies in the S\&P (Standard and Poor's ). The S\&P is a free-float, capitalization-weighted index of the top publicly listed. VOO. Vanguard S&P ETF. Also available as an Admiral™ Shares mutual fund. Buy. Source: Bloomberg, based on S&P constituents as of 3/15/ ROE weighted averages are based off of the sum of company-specific five year averages of. The Dow tracks 30 companies on US exchanges including blue-chip corporations such as Coca-Cola Co., Nike Inc., and McDonald's Corp. Almost all Dow stocks are. Widely regarded as one of the best gauges of the U.S. equities market, this world-renowned index includes a representative sample of top companies in. S&P ETF List: 16 ETFs ; SPY, SPDR S&P ETF Trust, State Street Global Advisors ; IVV, iShares Core S&P ETF, Blackrock ; VOO, Vanguard Index Fund. See the full list of companies included in S&P Index. Track their stock prices and other financial metrics to better understand SP:SPX performance. S&P y-n.site:INDEX. EXPORT download chart. WATCHLIST+. LIVESTREAMShark List. Clear. checkbox label label. Apply Cancel. Consent y-n.sitest.

Can You Buy 1 Share Of Tesla

To compare apples to apples, this means that the cost basis of the initial purchase price should be divided by 15, as one share of Tesla stock in would. Prior to its five-for-one stock split in , the price of a single share of Tesla had surpassed $ Tesla stock has continued to soar since the stock split. To purchase shares, you will need to do so through a broker. If you do not have a brokerage account, you will need to open one. At this time, Tesla does not. Yes, you can purchase fractional shares of Tesla, Inc. (TSLA) or any other US company shares in Angel One for any dollar amount. What is the market. Like other stocks, TSLA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To. Yes, you can purchase fractional shares of Tesla Inc (TSLA) via the Vested app. You can start investing in Tesla Inc (TSLA) with a minimum investment of $1. To buy shares of Tesla, you must have a brokerage account. If you need to open one, here are some of the best-rated brokers and trading platforms. This step-by-. Buyer - You can receive buyer benefits one time when you make your first purchase of a qualifying Tesla product through a friend's referral link. Referrer - You. Yes, Tesla Inc shares can be bought in India by opening an international trading account with Groww. How to Buy Tesla Inc Shares in India? To compare apples to apples, this means that the cost basis of the initial purchase price should be divided by 15, as one share of Tesla stock in would. Prior to its five-for-one stock split in , the price of a single share of Tesla had surpassed $ Tesla stock has continued to soar since the stock split. To purchase shares, you will need to do so through a broker. If you do not have a brokerage account, you will need to open one. At this time, Tesla does not. Yes, you can purchase fractional shares of Tesla, Inc. (TSLA) or any other US company shares in Angel One for any dollar amount. What is the market. Like other stocks, TSLA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To. Yes, you can purchase fractional shares of Tesla Inc (TSLA) via the Vested app. You can start investing in Tesla Inc (TSLA) with a minimum investment of $1. To buy shares of Tesla, you must have a brokerage account. If you need to open one, here are some of the best-rated brokers and trading platforms. This step-by-. Buyer - You can receive buyer benefits one time when you make your first purchase of a qualifying Tesla product through a friend's referral link. Referrer - You. Yes, Tesla Inc shares can be bought in India by opening an international trading account with Groww. How to Buy Tesla Inc Shares in India?

This valued Musk's stake in the company at $bn. Other Tesla executives hold less than 1%. Institutional investors hold less of Tesla's stock than some of. Get Tesla Inc (TSLA:NASDAQ) real-time stock quotes, news, price and We want to hear from you. Get In Touch. CNBC Newsletters. Sign up for free. Invest in Tesla, NASDAQ: TSLA Stock - View real-time TSLA price charts. Online commission-free investing in Tesla: buy or sell Tesla Stock commission-free. To buy shares in Tesla Inc, you'll need to have an account. Explore the you could get back less than you put in. Important information. Statutory. Step 1: Choose a broker · Step 2: Decide how much to invest · Step 3: Review TSLA stock performance and potential · Step 4: Choose how to invest. 13 years ago, you would have $91, today. Investment. $. Amount that you could have invested. Years Ago. you buy stocks, for example. CFDs attract overnight costs to hold the trades (unless you use shares and ETFs bought through a share dealing account can. Is Tesla stock a Buy, Sell or Hold? Tesla stock has received a consensus rating of buy. The average rating score is and is based on 50 buy ratings. Buy shares now, or wait for later? You can use a Limit Order to buy Tesla shares when they reach a price you're comfortable to buy them. A Limit Order will. Yes, with 5paisa you can purchase Tesla fractional shares or any other US company shares. What are the documents required to start investing in Tesla stocks? To. The whole process can take as little as 15 minutes. You'll need a smartphone or computer, an internet connection, your passport or driving licence and a means. Buyer - You can receive buyer benefits one time when you make your first purchase of a qualifying Tesla product through a friend's referral link. Referrer - You. Tesla (TSLA) Stock Moves %: What You Should Know. Sep. 3, at 5 Will They Get The Money?' Sep. 3, at a.m. ET on y-n.site BMW. We accept passenger cars, trucks, vans and SUVs for trade in towards the purchase of a new or used Tesla vehicle. Our common stock is traded on the Nasdaq Global Select Market under the symbol “TSLA.” The last reported sale price of our common stock on August 31, , as. How to buy Tesla stock · Choose a stock trading platform. Use our comparison table · Open an account. Provide your personal information and sign up. · Fund your. How can I buy Tesla, Inc. shares from India? Tesla Investing Risk — The trading price of TSLA has been highly volatile and could continue to be subject to wide fluctuations in response to various factors. You can buy shares through your broker through the secondary market or stock exchange. You can also invest in the company indirectly by purchasing shares of a. Thinking of buying or selling Tesla Inc stock that's listed in a currency different from your local one? Use our international stock ticker to check and.

Google Speech Api Pricing

Please refer to Google Cloud Price List for the latest pricing. We're currently using USD to calculate costs, which can be changed in the billing setup. Final. Hi, I'm building an app which has text to speech conversion. I'm evaluating all the possible text-to-speech API's including google cloud. New customers get $ in free credits to spend on Speech-to-Text during the first 90 days. Free trial starts spending after free monthly usage is exhausted. Speechnotes' API enables you to send us files via standard POST requests For example, for transcribing your recordings - we pay Google's speech to text. The cost for WaveNet is $16 for 1 million characters, which is 4x the price of a standard voice. If you create a Google Cloud Platform account, the first. Yep, as of today Google Cloud Speech to text costs USD for each 15 seconds meaning at best you'll get $ a second and pay 8x on Google cloud speech. Free Usage per Month: Under 60 minutes is free. Pricing: Speech-to-Text is priced based on the amount of audio successfully processed by the service each month. Pricing: Text-to-Speech is priced based on the number of characters sent to the service to be synthesized into audio each month and starting from $ USD per. Note: Additional charges may also apply from infrastructure you use to call the API. If you pay in a currency other than USD, the prices listed in your. Please refer to Google Cloud Price List for the latest pricing. We're currently using USD to calculate costs, which can be changed in the billing setup. Final. Hi, I'm building an app which has text to speech conversion. I'm evaluating all the possible text-to-speech API's including google cloud. New customers get $ in free credits to spend on Speech-to-Text during the first 90 days. Free trial starts spending after free monthly usage is exhausted. Speechnotes' API enables you to send us files via standard POST requests For example, for transcribing your recordings - we pay Google's speech to text. The cost for WaveNet is $16 for 1 million characters, which is 4x the price of a standard voice. If you create a Google Cloud Platform account, the first. Yep, as of today Google Cloud Speech to text costs USD for each 15 seconds meaning at best you'll get $ a second and pay 8x on Google cloud speech. Free Usage per Month: Under 60 minutes is free. Pricing: Speech-to-Text is priced based on the amount of audio successfully processed by the service each month. Pricing: Text-to-Speech is priced based on the number of characters sent to the service to be synthesized into audio each month and starting from $ USD per. Note: Additional charges may also apply from infrastructure you use to call the API. If you pay in a currency other than USD, the prices listed in your.

Free (F0) ; Speech Translation (per second billing), Standard, 5 audio hours free per month ; Speaker Recognition (per transaction billing), Speaker Verification. Google Cloud's Speech-to-Text API helps you accurately transcribe speech into text in 73 languages and different local variants. The new speech-to-text engine offers significantly better transcription accuracy and is more cost-effective at $ per minute compared to the existing. Cost and pricing structure · Whisper API follows a usage-based pricing model: customers pay $/minute for audio processing. · Google Speech-to-Text also. Google Cloud Speech-to-Text has 2 pricing edition(s), from $ to $ A free trial of Google Cloud Speech-to-Text is also available. Look at different. By using Google Speech Recognition (GSR) plugin to UniMRCP Server, IVR platforms can utilize Google Cloud Speech API via the industry-standard Media Resource. As of today (March 25, ) it is free while in technical preview stage, you can read more details here, Speech API - Speech Recognition. Pricing · Google Cloud Speech-to-Text (video model) is $ per minute of audio, charged in second increments, rounded up. · Amazon Transcribe charges for a. The Gemini API “free tier” is offered through the API service with lower rate limits for testing purposes. Google AI Studio usage is completely free in all. As of my last update, Google Speech-to-Text API offers a free tier, which includes 60 minutes of audio processing per month. Beyond this limit. I looked over the pricing and it seems that less than 1 million characters per month is free, 2 million is 16USD. I think it's unlikely that I'd exceed more. The pricing is tiered based on usage volume and starts at a competitive rate of USD per million characters. Neural2 Voices - $16/million bytes; Studio (Preview). By using Google Speech Recognition (GSR) plugin to UniMRCP Server, IVR platforms can utilize Google Cloud Speech API via the industry-standard Media Resource. The pricing for Google Cloud Text-to-Speech starts at $ Google Cloud Text-to-Speech has a single plan. Free Version. Free Trial ; Free Version. Free Trial ; Voice Recognition. (2) ; Multi-Language. (2) ; Sentiment Analysis. (1). The Gemini API “free tier” is offered through the API service with lower rate limits for testing purposes. Google AI Studio usage is completely free in all. Creating a Google Cloud Speech API key. There are a few steps but they're relatively easy. Pricing is free for the first 60 minutes per month and cents per. Google Cloud'sText-to-Speech is used to convert text into natural-sounding speech using an API powered by the best of Google's AI technologies. After you exceed the free limit, the price will be USD/character. WaveNet Voice: You get up to 1 million characters/month for free. After that, the.

How Do You Add Money To Chime

There are multiple ways to transfer money into your Credit Builder Secured Deposit Account. Use the Move My Pay feature in the Chime app. You can deposit cash into your Chime account at retailers like Wal-Mart, 7-Eleven, Walgreens, CVS, Dollar General, etc) (How do I deposit cash in my Chime. You can link an external bank account you own to your Chime Checking Account in the Move Money section of the Chime app or by logging into your account online. How do I transfer money from my Chime Checking Account to an external bank account? · Tap Move Money. · Tap the Transfer money button to go to the Transfer. How do I transfer funds between my Chime accounts? · Select Move Money on the top of the home page. · Select the desired From and To accounts. · Enter the. Dare accepted. You can now deposit cash into your Chime Checking Account fee-free at any of the + Walgreens® stores. Shoutout to Walgreens for. After going into the store, go to the MoneyCenter counter or the customer service desk and ask the cashier to load the amount onto your Chime card. Method 1: Link Your Chime Account To Your Cash App · Open the Cash App and choose “Add Bank.” Then select “Chime” from the options. · Log into your Chime bank. Just tell the cashier you want to load cash onto your chime card, hand them the cash and swipe the card. Did this once at a CVS before Chime. There are multiple ways to transfer money into your Credit Builder Secured Deposit Account. Use the Move My Pay feature in the Chime app. You can deposit cash into your Chime account at retailers like Wal-Mart, 7-Eleven, Walgreens, CVS, Dollar General, etc) (How do I deposit cash in my Chime. You can link an external bank account you own to your Chime Checking Account in the Move Money section of the Chime app or by logging into your account online. How do I transfer money from my Chime Checking Account to an external bank account? · Tap Move Money. · Tap the Transfer money button to go to the Transfer. How do I transfer funds between my Chime accounts? · Select Move Money on the top of the home page. · Select the desired From and To accounts. · Enter the. Dare accepted. You can now deposit cash into your Chime Checking Account fee-free at any of the + Walgreens® stores. Shoutout to Walgreens for. After going into the store, go to the MoneyCenter counter or the customer service desk and ask the cashier to load the amount onto your Chime card. Method 1: Link Your Chime Account To Your Cash App · Open the Cash App and choose “Add Bank.” Then select “Chime” from the options. · Log into your Chime bank. Just tell the cashier you want to load cash onto your chime card, hand them the cash and swipe the card. Did this once at a CVS before Chime.

Open your Chime app and go to the Move Money page. Tap Deposit Cash to view your deposit barcode.

Unfortunately, you cannot make a Chime ATM deposit. If you have cash on hand that you want to deposit in your Chime account, just find the nearest Walgreens®. You can also add money in your Chime card at another stores like Walmart, Dollar General and CVS. But the daily limit is only $ You can also. Select an account and choose “Transfer” or “Transfer Money” at the top of your account page. You will also have the option to add a memo. Step 4: Click. Transfers · Zelle®. Send money to friends and family using just their phone number or email address. · Wire Transfers. Send or receive money within the U.S., U.S. No physical chime card needed to deposit! Open your Chime app and go to the Move Money page. Tap Deposit Cash. Transfer funds quickly and securely with PayPal. Send money online to friends and family from your bank account or PayPal balance for free. Get started. AM. In response to Helen. I was able to add Chime to my Square as normal so were you able to move your money from square to your chime account? Cash deposit at a retail location. Cash deposits typically post within two hours of a successful transaction. Checks deposited through the Chime mobile app. 7-Eleven charges a fee of $3 to load your Chime card. This is higher than the free reload option available at Walgreens and Duane Reade, but. Things You Should Know · To move money from Chime to Cash App, add your Chime debit card to Cash App. · You can also link your Chime bank account to Cash App to. You can link your external account to your Chime Checking Account on the website under Settings > Linked Accounts. Cash deposits to a Chime Checking Account are funds transfers made by third parties (who may impose their own fees or limits) and are FDIC-insured up to. Cash deposit at a retail location. Cash deposits typically post within two hours of a successful transaction. Checks deposited through the Chime mobile app. When you transfer money from your Apple Cash1 card, you can either use a bank transfer to send funds to your bank account in 1 to 3 days or you can use Instant. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Method 1: Link Your Chime Account To Your Cash App · Open the Cash App and choose “Add Bank.” Then select “Chime” from the options. · Log into your Chime bank. Transfers to Chime members are instant and irreversible. Please make sure your payment details are correct before confirming, as our Member Services team can't. You can also deposit money in your account using mobile check deposit² or electronic transfer from other financial institutions. Adding cash to your account. Pay Anyone: Chime offers a service called Pay Anyone that allows you to send and receive money from anyone, even if they don't have a Chime. 1. Electronic funds transfer. Direct deposit is the simplest way to fund your Chime account. · 2. monetary deposit. If you have cash to deposit.

What Is Bid Price

BID PRICE definition: the amount that a buyer is willing to pay for particular shares, etc.. Learn more. The ask price is the lowest price a trader is willing to offer that market at. As a market's price moves, so too will the bid and ask prices. The spread often. Bid prices refer to the highest price that traders are willing to pay for a security. The ask price, on the other hand, refers to the lowest price that the. The bid price focuses on the highest price a trader is prepared to pay to go long (buy) on an asset and the ask price is the lowest price a trader is prepared. The bid price is the highest price a buyer (or “bidder”) is willing to pay for an asset. It represents the demand side of the market equation. Bid-Ask Spread is the difference between the quoted ask price and the quoted bid price of a security listed on an exchange. The bid price is the price at which a trader can sell an underlying asset to a broker or market maker. From the perspective of the market maker, the bid price. The Bid is the price that buyers are willing to pay for a stock. The Ask is the price that sellers are willing to sell a stock for. The bid price is the price that an investor is willing to pay for the security. For example, if an investor wanted to sell a stock, he or she would need to. BID PRICE definition: the amount that a buyer is willing to pay for particular shares, etc.. Learn more. The ask price is the lowest price a trader is willing to offer that market at. As a market's price moves, so too will the bid and ask prices. The spread often. Bid prices refer to the highest price that traders are willing to pay for a security. The ask price, on the other hand, refers to the lowest price that the. The bid price focuses on the highest price a trader is prepared to pay to go long (buy) on an asset and the ask price is the lowest price a trader is prepared. The bid price is the highest price a buyer (or “bidder”) is willing to pay for an asset. It represents the demand side of the market equation. Bid-Ask Spread is the difference between the quoted ask price and the quoted bid price of a security listed on an exchange. The bid price is the price at which a trader can sell an underlying asset to a broker or market maker. From the perspective of the market maker, the bid price. The Bid is the price that buyers are willing to pay for a stock. The Ask is the price that sellers are willing to sell a stock for. The bid price is the price that an investor is willing to pay for the security. For example, if an investor wanted to sell a stock, he or she would need to.

The bid price is the highest price a buyer is prepared to pay for a financial instrument, while the ask price is the lowest price a seller will accept for the. A bid is the maximum price a buyer is prepared to shell out for stock, whereas an ask is the lowest rate a seller is willing to take. Read on to know more! The firm is “bidding” on the security in the market in hopes of a customer showing up and selling. In addition to the bid price, the market maker also specifies. Bid Price: the highest price a buyer is willing to pay. In other words, the ask price is the price at which you can buy the asset if you wish . A bid price is the highest price that a buyer (i.e., bidder) is willing to pay for some goods. It is usually referred to simply as the "bid". In bid and ask. A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market. The bid price is the price investors are willing to pay for an asset. The ask price is the price at which investors are willing to sell the asset. The spread. It is usually called “bid” in many markets. In share market, when a buyer places an order to buy shares, they specify the quantity and the price at which they. A bid is the highest price a buyer is willing to pay for a single share or another unit of a particular financial security at a given moment in time. Bid price is what someone who wants to buy a thing is willing to pay for it. Ask price is the price someone selling a thing is willing to sell. Lesson Summary. In the stock market: The bid price is the price that an investor must pay to purchase a share of a stock. The ask price is what that stock can. Bid price is the price at which a dealer is willing to buy a security while ask price is the price at which a dealer is willing to sell a security. Bid price represents what buyers will pay for that particular stock and the bid size represents how much a trader is willing to buy at that specific price. The bid price focuses on the highest price a trader is prepared to pay to go long (buy) on an asset and the ask price is the lowest price a trader is prepared. Bid price. Browse Terms By Number or Letter: This is the quoted bid, or the highest price an investor is willing to pay to buy a security. Practically. The ask price is the rate at which your broker is willing to sell and represents the rate you must pay to buy the currency pair. The bid. What is bid and ask? Bid price: The bid price is the maximum price that a buyer is willing to pay for an asset. It represents the level of demand there is. The ask price is concerned with the least price a vendor will acknowledge for security. The bid price is concerned with the most exorbitant cost a purchaser. A two-way price quotation that indicates the best price at which a security can be sold and bought at a given point in time. The bid price represents the.

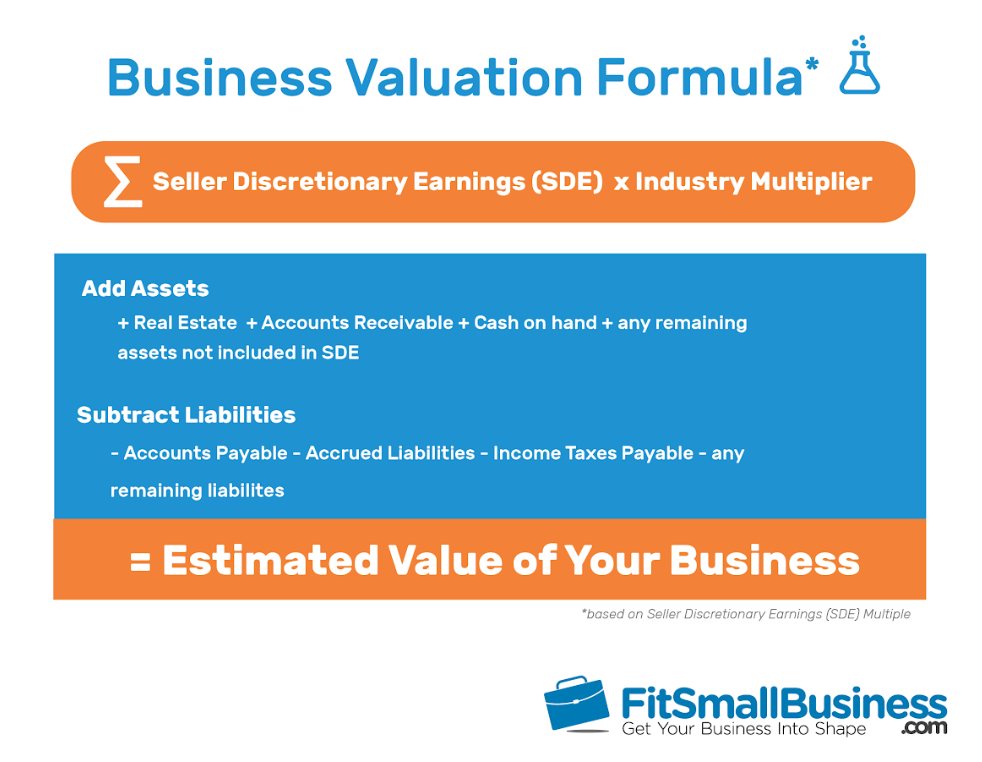

Valuation Of The Company Formula

Enter in the information on our valuation spreadsheet and our software will calculate the value of your small business. Within the income approach, the FCF method is frequently used to value larger, mature private companies. For smaller companies or in special situations, the. The Net Book Value (NBV) of your business is calculated by deducting the costs of your business liabilities, including debt and outstanding credit, from the. It is calculated by combining the company's market capitalization with its debt, subtracting its cash and cash equivalents. Calculating the market cap is simple: Multiply the share price by the total number of shares outstanding (the number of shares of common stock a company has. #1 Income Approach. It estimates the value of a business based on its expected future income. Example: For example, if a company expects to generate $, Enterprise Value is the value of the company's core business operations (i.e., Net Operating Assets), but to ALL INVESTORS (Equity, Debt, Preferred, and. One of the simplest methods of calculating goodwill for a small business is by subtracting the fair market value of its net identifiable assets from the price. Equity value is found by taking the company's fully-diluted shares outstanding and multiplying it by a stock's current market price. Fully diluted means that it. Enter in the information on our valuation spreadsheet and our software will calculate the value of your small business. Within the income approach, the FCF method is frequently used to value larger, mature private companies. For smaller companies or in special situations, the. The Net Book Value (NBV) of your business is calculated by deducting the costs of your business liabilities, including debt and outstanding credit, from the. It is calculated by combining the company's market capitalization with its debt, subtracting its cash and cash equivalents. Calculating the market cap is simple: Multiply the share price by the total number of shares outstanding (the number of shares of common stock a company has. #1 Income Approach. It estimates the value of a business based on its expected future income. Example: For example, if a company expects to generate $, Enterprise Value is the value of the company's core business operations (i.e., Net Operating Assets), but to ALL INVESTORS (Equity, Debt, Preferred, and. One of the simplest methods of calculating goodwill for a small business is by subtracting the fair market value of its net identifiable assets from the price. Equity value is found by taking the company's fully-diluted shares outstanding and multiplying it by a stock's current market price. Fully diluted means that it.

You calculate book value by totaling every asset a company possesses and every liability that the company holds. Enter in the information on our valuation spreadsheet and our software will calculate the value of your small business. Equity value is the total value for the company's shareholders. The formula for equity value is market capitalization plus fair value of stock options plus fair. A stock is considered to be at fair value when P/E Ratio = Growth Rate. Through our partner Trading Central, we analyze key criteria to indicate whether the. The formula for EV is the sum of the market value of equity (market capitalization) and the market value of a company's debt, less any cash. A company's market. worth in mergers & acquisitions (M&A). The formula for enterprise value is the market capitalization of a company, plus total debt, minus cash and cash. The next step in this valuation process is to assign a target company impact (in percentage form) to each parameter and calculate the factor strength by. The P/E ratio equals the company's stock price divided by its most recently reported earnings per share (EPS). A low P/E ratio implies that an investor buying. The P/E ratio equals the company's stock price divided by its most recently reported earnings per share (EPS). A low P/E ratio implies that an investor buying. A venture that earns $1 million per year in revenue, for example, could have a multiple of 2 or 3 applied to it, resulting in a $2 or $3 million valuation. This tool calculates two 'valuations' based upon your sales, cost of sales and other factors. We then present these as a range, displaying the lowest '. Price-to-earnings ratio (P/E): Calculated by dividing the current price of a stock by its EPS, the P/E ratio is a commonly quoted measure of stock value. In a. Dividing the total value of equity by the number of outstanding shares gives the value per share. The WACC formula is. WACC. The Capitalization of Earnings method values a company by looking at its earnings. It assumes that what a business earns regularly tells us its market value. To. Business valuation is a process and a set of procedures used to estimate the economic value of an owner's interest in a business. Here various valuation. A stock is considered to be at fair value when P/E Ratio = Growth Rate. Through our partner Trading Central, we analyze key criteria to indicate whether the. Software companies are generally worth somewhere between 1 and 2 times annual revenue. If your company is unprofitable, not growing, has a small market share. Company Value = Cash Flow / (Discount Rate – Cash Flow Growth Rate), where Cash Flow Growth Rate formula. Calculating the market cap is simple: Multiply the share price by the total number of shares outstanding (the number of shares of common stock a company has. Learn about the EBITDA Valuation method which is often used to determine the Enterprise Value of a Business and what types of businesses should use it.